When will the "Stock market" crash ?

I wish i knew that but i can tell you many reasons why there is always a fear at the back of people’s mind that the market may crash soon and they would not be able to further enjoy the bull ride.

Just like many people cannot make a decision to “Buy” the stocks when the market is falling, many people are also not able to “Sell” the stocks while making a profit because they tend to think that the bull ride will keep going on forever.

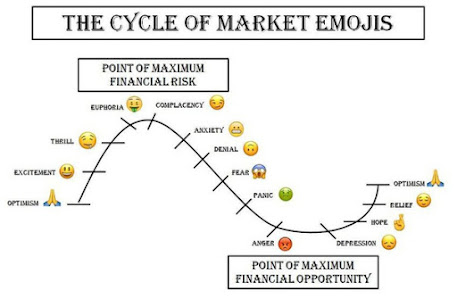

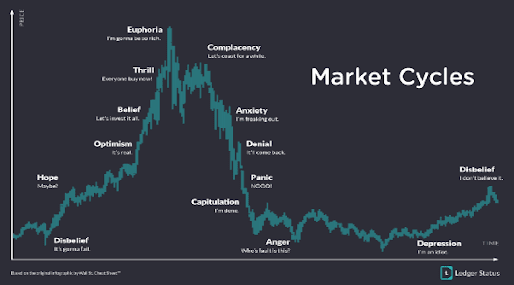

In psychological terms, we can call the stock market a cycle of “Greed & Fear”.

I know what you are thinking :

Everybody knows this, what is new about this Post ?

OR

How do you determine in which phase the price actually is ?

Stick with me till the end.

In the above image you can see clearly where the maximum risk and the maximum opportunity lies.

But 98 % of people who lose in the market generally “Buy” a stock when they are excited about the market and usually don't “Sell” when the price rises due to "Greed" that the price will touch the moon and never go down from their buying levels.

As Sir John Templeton says “Bull markets are Born at Pessimism, Grow on Skepticism, Mature on Optimism & finally Die at Euphoria”.

Till

the time you have bought a stock in the cash market, there is only 1

way to profit from the market and that is to sell it at the higher price,

of-course there has to be another buyer at that price in order to do so.

Until you press that “Sell” button, all your profits will be in the books and you will not be taking anything home.

Much of money game is played at valuations and each round of investment decides the valuation or what that equity percentage is worth as on the last transaction.

Until the Founder and big investors are able to cash in on that amount they are worth a fortune only on paper.

Want to take a wild guess who makes them a real "Billionaire" ?

Retail investors like us do that.

When the IPO [Initial public offering] of any particular company is launched, it becomes available to be traded among traders and investors in the Secondary market.

There is nothing wrong in Buying “Microsoft” when it is almost valued at three times of its book value because it is a promising growth stock.

However tides turn when you end up “Buying” Snap-chat at half a trillion dollar valuation, that is where the real pain lies".

Most people lose money because they “Buy high" in "Greed" thinking the price will rise more and “Sell low" in "Fear" of losing more.Peter lynch says “More money has been lost in trying to predict a correction than in an actual correction itself”.

Also says “Everyone seems to know the Price of everything but the value of nothing”.

Coming to the “Conclusion”.

What can people like you & me do then ?

- “Buy” low & “Sell” high.

- Don’t try to catch exact top and bottom, partially keep booking your profits and leave as little money on the table as you can to always be prepared for when the tide turns.

- Start learning, reading, watching, grasping knowledge about the Market because in market, knowledge is your weapon as making money is a war in this zero-sum world & if you go to a war without any weapon you will surely die.

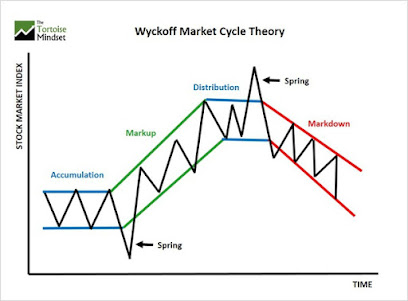

- To get a better understanding of where the “Price” is in the market cycle, learn about Fundamental & Technical analysis.

- Do not mess with the Trend.

- Liquidity is the single major driving factor behind any market just keep that in mind.

No comments:

Post a Comment