How to get best "Return on your overall Portfolio with lowest possible Risk" !!

It is easy to get distracted in today's age, but when we are talking about "Money/ Investment", it becomes one of the most important decisions of our life, so i would request your attention for just 10 minutes.

To explain in the best possible way, i am writing this article "End to End".Let us start with understanding "What is financial planning" !!

It includes mainly 6 points :

- Tax planning.

- Insurance planning.

- Investment planning.

- Retirement planning.

- Estate planning.

- Goal planning like Child's education, Child's marriage, Buying a car, Buying a home etc.

- Age.

- Employment.

- Nature of job.

- Psyche.

- Earning members in the family.

- Number of dependents.

- Capital base.

- Regularity of income.

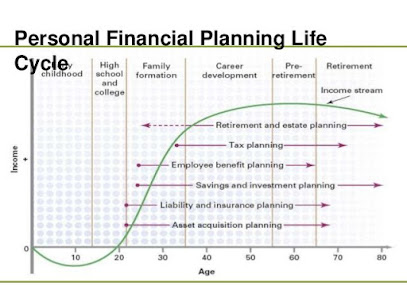

Now let us understand "What is a Financial life-cycle" !!

In "India", Children are dependent on their parents till the age of 22 and don't have any income stream generally. During these years, the focus should be to"Save" from the pocket money.

After graduating from college, one needs to "Save money from the salary received and start Investing".

The Investment, at this point of time can be made towards "Buying a car or going to a vacation".

When one gets married around the age of 25 or so, the salary would increase by some amount and the portion of "Saving & Investment" should also be increased by some percentage. At this stage in life, one needs to think about "Insurance" as-well.

As a person starts family, he/she witnesses growth in career along with higher salary and more experience. The expenses also rise, so one needs to "Save & Invest" some more percentage of the amount received and start thinking about "Tax planning, Retirement planning & Goal planning".

A person needs to be cautious about the "Financial situation & Budget" at all times.

While making a "Financial plan", people generally tend to ignore a very important part of it which is "Inflation rate".

"Inflation" basically means that "The price of Goods & Services increases over a period of time".Below is a simple example to show the "Impact of Inflation" :

As the "Inflation" increases, the cost of goods & services increases.

If a person could have bought 2 apples for 10 rupees in the year 2000, then in 2015, he/she would only be able to buy 1 apple for the same 10 rupees.

Thus we say can that "As inflation increases, the value of money goes down".

This is why "Investing" is important.

Now that we understand all this, let us take a look at "How we can get best Return on our Portfolio with lowest possible Risk" !!

There are over 45 Asset management companies (Mutual fund companies) in India which have over 900 schemes but broadly all of them can be categorized into following :

1. Liquid funds or Cash management funds (Very low "Risk", very low expected "Return").

2. Arbitrage funds (Low "Risk", low expected "Return").

3. Bond funds/ Debt funds - These are further categorized into 3 parts based on the "Holding period'.

* Tenure of 3 months to 1 year (Low "Risk", low expected "Return").

* Tenure of 1 year to 3 years (Medium "Risk", medium expected "Return").

* Tenure of over 3 years (Higher than medium "Risk", higher than medium expected "Return").

4. Equity funds (High "Risk", high expected "Return").

The longer the "Time horizon" for a goal, the more suitable "Equity" becomes for an "Investment".

Equity funds can further be categorized into [Sector, Thematic or Diversified] and each of these can also be further categorized into [Small-cap, Mid-cap & Large-cap/ Blue-chip].

5. Gilt funds (These funds invest in Government or Government backed securities).

6. Balanced/ Hybrid funds (These are a mix of Debt and Equity funds).

7. Index funds (These funds track the broad market and have a underlying benchmark to an "Index").

8. Income funds.

All this being said, let us take a look at all the "Asset classes" one can invest in :- Mutual funds.

- Real estate.

- Gold/ Precious metals/ Minerals.

- Art/ Antiques/ Collectibles.

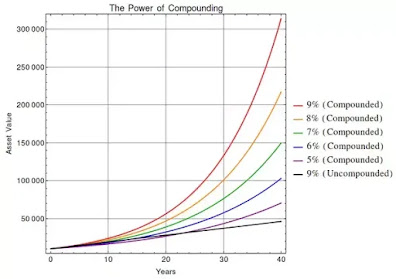

When we construct our detailed "Portfolio" keeping all these things in mind, we can say that we have put our "Money" to the best use and we can expect to benefit from the "Power of compounding".

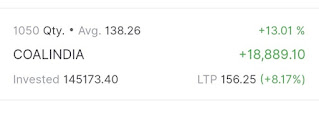

Just to give a brief idea, below is an example to show "How much a small change in return percentage" can affect our "Portfolio" :To connect with us for "Free", you can checkout the links below :Telegram : Logical Investor

Whatsapp : +91 8527767668

Quora : Trade & Invest

Regards !!