Why acquiring "You-tube" is considered to be the best deal made by "Google" ?

Google wanted to be "The default platform for user generated content and the hub for the young generation" because being the default platform for content makes them the "Default ad network".

At the time when Google acquired You-tube, it was clear that video would become one of the most valuable forms of content going forward.

There was long term value to be created in

the business and "Google" grabbed that opportunity.

They were one of the few companies with the scale and resources to deal with the mind-boggling data and bandwidth volumes necessary to service this segment. To truly leverage video content for ad targeting and delivery requires a heavy investment in R&D. The more metadata they can associate with video the more they can monetize the content through ads. To make video searchable requires voice recognition technology to convert speech to text and image recognition technology to parse video frames. Google had the budget, talent and head start to win at these endeavors.

YouTube was burning through cash, running out of server space and weathering litigation threats from record labels. Its staff was working around the clock and its founders were growing increasingly wary of how to sustain the company without any muscle in its corner.

Google bought YouTube for $ 1.65 billion. That figure seems quaint now but at that time it was an eye-popping figure to pay for a startup only a year and a half old.

There certainly is an argument for a couple of tiny investments that paid off incredibly like Google’s $ 50 million acquisition of "Android" in 2005. The difference is that at that time no one outside Silicon Valley knew what Android was.

YouTube was already world famous

when Google snapped it up and its price tag was ridiculous by

conventional standards. It was one of the first wild bets a tech giant

made following the "Dot-com crash".

Advantages of the deal were that it :

Eliminated a Direct competitor in the Market.

Improved company's core business and helped Google in Distinguishing itself from other search engines.

You-Tube had

the infrastructure and the eyeballs - It just needed the kind of content

the TV industry respects and understands in order to prevent throwing the towel to Netflix, Facebook and the likes in the future.

Google’s stock climbed to an "All time high" shortly after the YouTube acquisition in 2006 and it’s been part of the company’s growth narrative ever since.

YouTube rid us of the scourge of buffering, it benefited the users.

It created a financial ecosystem that encouraged creatives to launch independent businesses.

It let us stream almost any song we wanted to listen to and any movie we wanted to watch for "Free".

At the time of writing, "You-tube" has 1000 million views per day & it generates what it spent to acquire "You-tube" in the form of revenue every week.

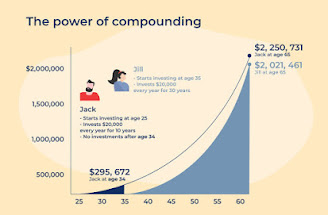

That is why i think it is a very good example of "Value-Investing".

To connect with us for "Free", you can checkout the links below :

Telegram : Logical Investor

Whatsapp : +91 8527767668

Quora : Trade & Invest

Regards !!