How "Warren Buffet" Invests his Money !!

Some call him "The Oracle of Omaha" & some know him as "The Disciple of Benjamin Graham".

"Benjamin Graham" is credited with being "The father of Value-Investing".

The 2 must read books for any "Investor" are as follows :

1. The Intelligent Investor.

2. Security analysis.

Most "Fund Managers" & "Investment Officers" have read these 2 books.

I graduated as an "Engineer" in "Electronics & Communications" so you can say at the time i started learning about "Capital Markets", i did not had any relevant qualification.

My father being an "Avid" watcher of "Stock Market" since 1992, advised me to "Read everything i can about this Humble Human Being" and that is what i did.

I am providing a link in the next line so that you can go through my favorite "Investing & Trading quotes". It will help me in saving my "Time" and as "Warren Buffet" says "It is the most important & precious asset anyone can have".

"My favorite Investing & Trading quotes" !!

Mr. Warren Buffet is somewhat a "Humble & Frugal" man.

He says that "If keep buying things that you don't need, then soon you will have to reluctantly sell things that you really need".

Don't worry, i will talk about the "Real deal" & "Technical terms" soon. I wont stop just by "Writing only what most people already know".

"Mr. Warren Buffet" is a firm believer in "Reading at-least 5 hours a day if not more".

Since we are talking about "Learning on day to day basis & Reading", i am sharing my "Favorite books that i have come across during my 5.5 years of learning journey" in the link below :

"My favorite books on Capital markets" !!

Well enough of the "Base Building", now let us dive into "How Warren Buffet Invests his Money".

The first thing that one needs to do for "Shortlisting" a company is to perform "Fundamental analysis" on the "Stocks listed in the broad market".

The whole idea of "Fundamental analysis" revolves around the concept of determining the “Intrinsic value” of a security so that we can understand whether it is "Over-valued, Fairly-valued or Under-valued".

Price is what you pay & value is what you get -- WARREN BUFFET

We all know the price of something that we are "Buying or Selling" but how do we determine its value is what decides our investment’s future.

Fundamental analysis is mainly divided into 3 parts namely :

- Economy analysis based on Macro-economic factors such as State of the economy, Political system, Demography, Government spending, Taxes, Wages, Import & Export, Trade Deficit/ Surplus, Fiscal Deficit/ Surplus, Foreign exchange currency, Oil price, Fiscal policy, Monetary policy, Inflation rate, Interest rate, Money supply, Quantative easing, Liquidity, GDP & Market capitalization/ GDP.

- Industry analysis based on which Stage the industry is in its life-cycle, Demand & Supply statistics, Competition within the industry, External threats for industry, Future prospects of industry, Credit system and Technological changes.

4 engines of the economy [Consumption, Export, Investment & Government].

SWOT Analysis [Strengths, Weaknesses, Threats & Opportunities].

- Company analysis based on Balance sheet (Share capital, Reserves & surplus, Current liabilities, Other liabilities, Current assets, Fixed assets, Other assets & Contingent liabilities), based on Income statement (Sales, Other income, Total expenditure, Earning before interest and tax, Interest, Tax & Net profit) and Net cash-flow from (Operating, Financing & Investing activity).

“Warren Buffet” uses “Discounted cash-flow model” in order to arrive at any "Company's Intrinsic Value".

Also known as “DCF” the idea here is to “BUY” the companies whose price is trading below the “Intrinsic value”.

We determine this value by first looking at our holding period.

Suppose we want to invest in a company for 10 years.

We have to look at the fact that “How much Net cash-flow” will that company be able to generate over the period of next 10 years.

If

today we are paying 100 rupees for a company then ideally it should be

able to generate a “Net cash-flow” of 500 rupees over the period of next

10 years for our investment to be viable according to the expected return in equity segment.

That is why ‘Warren Buffet’ says “Our favorite holding period is forever”.

- Never borrow & invest.

- Never invest 100 %.

- Always have some cash in hand for rainy day.

- Don’t put all your eggs in one basket.

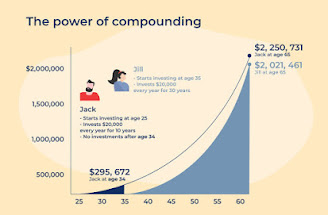

- Compounding is the 8th wonder of the world.

- Patience is the key.

- Spend time in the "Market" instead of timing the market.

Above mentioned are the "6 Cardinal rules of Investing" !!

"Crashes in Indian Stock Market" despite which the market is near high today :

1982, 1991, 1992, 2004, 2006, 2007, 2008, 2009, 2015, 2016, 2018, 2020.

"Warren Buffet" has been "Investing" for well over 70 years and besides selecting "Good companies" along the way in his journey, he has let the "Power of Compounding" work for him in his favor.

"Be Fearful when others are Greedy and be Greedy when others are Fearful".

To connect with us for "Free", you can checkout the links below :

Telegram : Logical Investor

Whatsapp : +91 8527767668

Quora : Trade & Invest

Regards !!